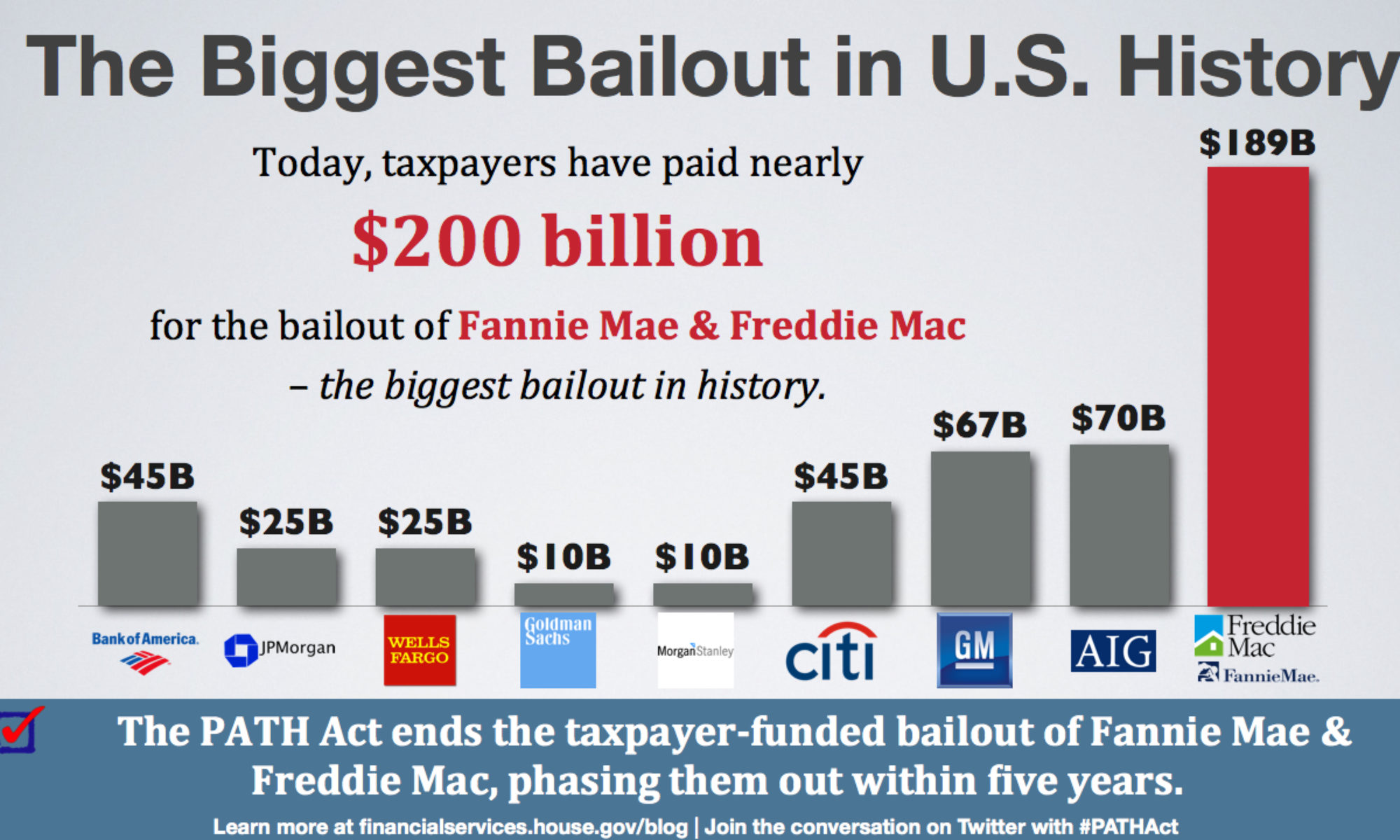

In 2008-2009, Barack Obama pushed and passed legislation that would spend billions of tax payer dollars in order to “bailout” Americans that were underwater due to the Great Recession that began in 2007. We believe that bailing out homeowners that had taken too much equity out of their homes, hence were now under water on their mortgage loans, is a huge tragedy. Many of those home owners did not save the equity in their home for a “rainy day”, like the Great Recession. Instead, the U.S. Government bailed them out with billions in taxpayer dollars. Here are a few reasons why you should oppose the bailout.

About Us

Angry Renter is movement. We have set out to be a voice for all renters across the U.S. that have been taken advantage of by landlords and real estate investors, in an effort to maximize profits and pad their own pockets, while leaving tenants/renters holding the bag when the dust settles. During the recession a few years ago, professional home buyers in Texas & real estate investors across the U.S. pocketed thousands of dollars from their tenants, while not paying the underlying mortgage payment, thereby becoming delinquent on their mortgage.

Under normal circumstances, banks would simply foreclose on the underlying mortgage, and take back the assets, but instead the U.S. government decided to bail out mortgage companies across the U.S., thereby bailing out the investors that were profiting hand over fist from their tenants. Here at AngryRenter.com, our core aim is to shed light on the travesty that’s occurred.

Blog

this is the blog page

The House Should Look Spacious

If the home has large furniture, you can remove them to make the property look more prominent. You have to leave the house for free as possible. Doing this gives the potential buyer the ability to imagine how he could decorate it. Let light come in The luminosity plays a key role. People will not …

For Sale House! Tips For A Sale Without Problems

Do you want to sell your house but do not know precisely what the process is? Here, a specialist, like a real estate agent, can help us in the final valuation of our home. Finally, with price and papers in order, it is apparent that we will receive visits from potential buyers. Here are some …

Continue reading “For Sale House! Tips For A Sale Without Problems”

Contact Us

Get in touch and we’ll get back to you as soon as we can. We look forward to hearing from you!